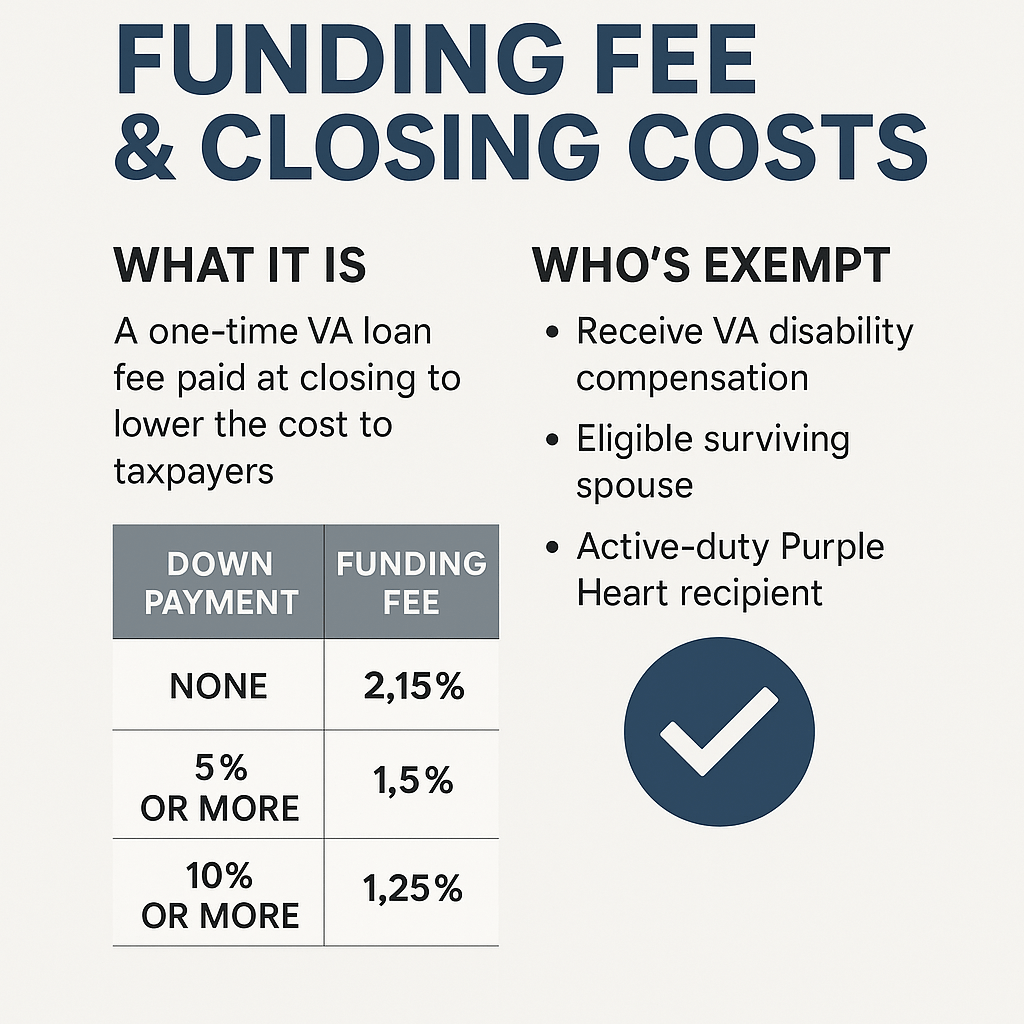

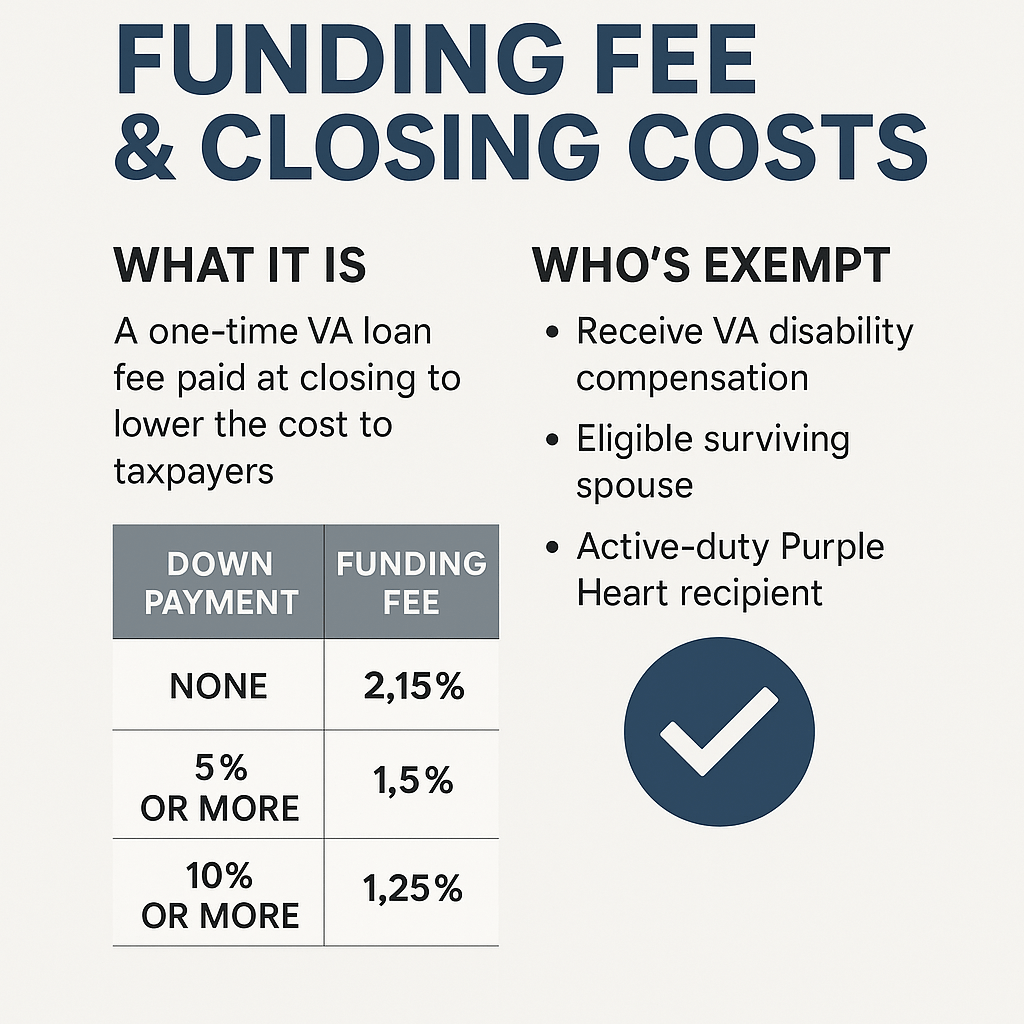

Funding Fee and Closing Costs: what it is, who’s exempt

The VA funding fee is a one-time charge most veterans and service members pay when using a VA home loan. It helps keep the program running with no ongoing cost to taxpayers.

How much is it?

It varies based on the type of loan (purchase, IRRRL refinance, construction), whether it’s a first-time or subsequent use, and the down payment (if any).

•First-time use, no down payment: 2.15% of the loan amount

• Subsequent use, no down payment: 3.3%

• With 5–10% down: 1.5%

• With 10% or more down: 1.25%

(For an IRRRL/streamlined refinance, it’s just 0.5%.)

How it’s paid:

You can pay it upfront at closing or roll it into the loan balance.

VA Closing Costs

While VA loans limit what lenders can charge, buyers are still responsible for some closing costs, typically around 1–3% of the loan amount. Common items include:

• Appraisal fee

• Credit report fee

• Origination fee (capped at 1%)

• Title insurance and recording fees

• Prepaid taxes and homeowners insurance

Sellers are allowed to cover some or all of the buyer’s closing costs, and VA guidelines allow up to 4% of the loan amount in seller concessions (for things like paying off collections, prepaid taxes, funding fee, etc.).

Who’s Exempt from the Funding Fee

Not every veteran has to pay the VA funding fee. You’re exempt if you fall into one of these categories:

• You receive VA disability compensation for a service-connected condition.

• You would receive compensation but are receiving retirement or active-duty pay instead.

• You’re the surviving spouse of a veteran who died in service or from a service-connected disability.

• As of 2020, Purple Heart recipients serving on active duty are also exempt.

If you qualify, your Certificate of Eligibility (COE) will reflect the exemption, and the funding fee won’t be added to your loan.

Northwest Realty Source

Principal Broker/Owner

Veteran-Marine Corps Sgt. Fox 2/4

Text or Cell 503.997.4169